Wealth Management: More or Less Money?

Explore the intriguing question of whether having less or more money can lead to greater wealth management. Understand the differences and learn effective money management strategies to enhance your financial future.

MONEY & LIFESTYLE

Difference between basic & Sophisticated lifestyle

Courtesy: Youtube Channel @morningmoneybuzz

What do you mean by having a basic lifestyle and sophisticated lifestyle?

Before exploring the topic, let's know the difference between having more money and having less money .

We love to show off because we love having more money, more wealth, more respect, more achievements, more success. And there’s nothing wrong with such ambitious ideas, but can we explore an alternative? An alternative to not running after social norms of having everything more perfect. If you speak logically, you are living in a fake world.

Everyone wants luxury, everyone wants high-level achievements, and everyone should be ambitious. Can we survive with the concept of having less and not having more?

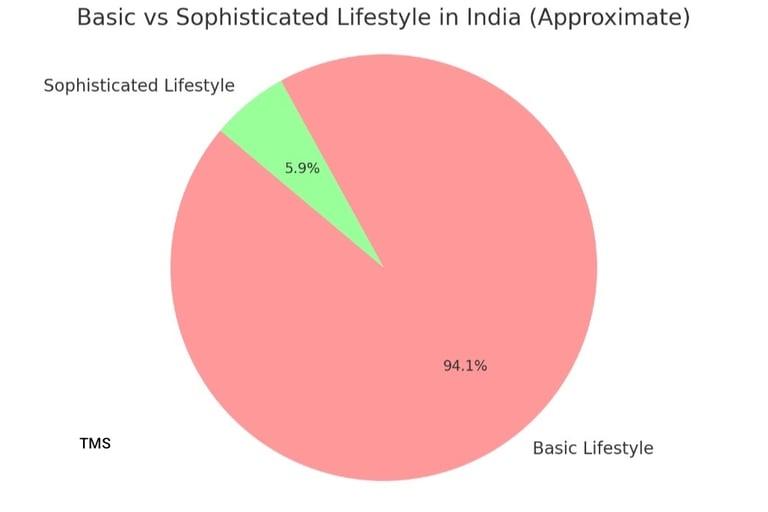

Percentage of Basic and Sophisticated lifestyle in India

What is Financial Detox : How is it different in Western and Eastern Culture

Basic Lifestyle

Less Spending

More Savings

Lower Costs of Living

Choosing “Enough”

“No-Buy Month”

Invest in Fewer, But Better Things

Sophisticated Lifestyle

Excess Spending

Materialistic Saving

Higher Cost of Living

Choosing more than Enough

Financial Detox

Non-Conservative Investment

Suggestions

1. Neither excessive nor less spending habits are considered intellectual. Both will make you fragile, and weak.

2. Savings itself is always healthy and will always make you wealthy. People have different perspectives. But materialism should not always be considered as spending and not saving. If your materialistic investment is smart enough, you are saving and earning an experience to cherish. But materialism can drain your wealth soon and can make you look foolish if you don’t know where and how to spend.,

3. A balanced cost of living should be targeted for your overall financial well-being, and it should be neither high nor low.

4. Choosing more than enough should always be an ambition. It will increase your competitiveness and fighting spirit, and aspiration to win.

5. Financial Detox always wins over a no-buy month. You cannot have a no-buy month. it’s practically impossible to achieve. Money detox should be governed with regulation and restraint.

6. Non-conservative investments are okay if they are not extravagant, unnecessary, and immensely risk-related.